Import tariff searching tools

29/03/2024 171. Searching import tariffs into Vietnam

Businesses can search import tariffs into Vietnam through the "Tariff - HS code" searching tools provided by the General Department of Customs (https://www.customs.gov.vn/index.jsp?pageId=24&id=NHAP_KHAU&name=Nh%E1%BA%ADp%20kh%E1%BA%A9u&cid=1201 /

https://www.customs.gov.vn/index.jsp?pageId=2313&id=NHAP_KHAU&name=Imports&cid=4154)

This is the official source for researching Vietnam's current import tariff rates. Here, businesses can find information on:

(i) Preferential import tariffs – the MFN tariff rates that Vietnam applies to WTO member countries.

(ii) Special preferential import tariffs – the tariff rates under FTAs that Vietnam applies to FTA partner countries.

(iii) Normal import tariffs – the tariff rates that Vietnam applies to non-WTO member countries.

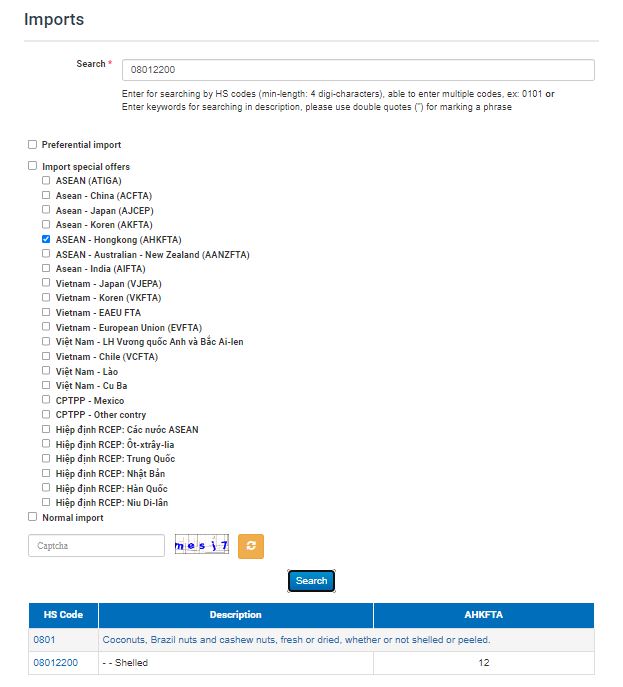

To search for import tariffs for a specific commodity, businesses only need to give information about:

(i) Description of the goods (by HS code or keyword)

(ii) Type of import tariffs to be searched (preferential tariff, special preferential tariff, or normal tariff)

For example:

Note: To look up Vietnam's import tariff rates for FTA partner countries for the following years, businesses can search for the Decree on Vietnam's Special Preferential Import Tariffs to implement FTAs.

- ASEAN (ATIGA): Decree No.126/2022/ND-CP on Special Preferential Import Tariffs for implementation of the ATIGA in the period 2022 – 2027

- ASEAN - China (ACFTA): Decree 118/2022/ND-CP on Preferential Import Tariffs for implementation of the ACFTA in the period 2022 - 2027

- ASEAN - Japan (AJCEP): Decree No.120/2022/ND-CP on Special Preferential Import Tariffs for implementation of the AJCEP in the period 2022 – 2028

- ASEAN - South Korea (AKFTA): Decree 119/2022/ND-CP on Preferential Import Tariffs for implementation of the AKFTA in the period 2022 - 2027

- ASEAN - Hong Kong, China (AHKFTA): Decree No.123/2022/ND-CP on Special Preferential Import Tariffs for implementation of the AHKFTA in the period 2022 – 2027

- ASEAN – Australia/New Zealand (AANZFTA): Decree No.121/2022/ND-CP on Special Preferential Import Tariffs for implementation of the AANZFTA in the period 2022-2027

- ASEAN - India (AIFTA): Decree No.122/2022/ND-CP on Special Preferential Import Tariffs for implementation of the AIFTA in the period 2022 – 2027

- Vietnam - Japan (VJEPA): Decree No.124/2022/ND-CP on Special Preferential Import Tariffs for implementation of the VJEPA in the period 2022 – 2028

- Vietnam - South Korea (VKFTA): Decree No.125/2022/ND-CP on Special Preferential Import Tariffs for implementation of the VKFTA in the period 2022 – 2027

- Vietnam - Eurasian Economic Union (VN-EAEU FTA): Decree No.113/2022/ND-CP on Special Preferential Import Tariffs for implementation of the VN-EAEU FTA in the period 2022-2027

- Vietnam - EU (EVFTA): Decree No.116/2022/ND-CP on Preferential Import and Export Tariffs for implementation of the EVFTA in the period of 2022-2027

- Vietnam - The UK (UKVFTA): Decree 117/2022/ND-CP on Preferential Import and Export Tariffs for implementation of the UKVFTA Agreement in the period of 2022-2027

- Vietnam - Chile (VCFTA): Decree No.112/2022/ND-CP on Special Preferential Import Tariffs for implementation of the VCFTA in the period 2022 – 2027

2. Searching import tariffs into FTA partner countries

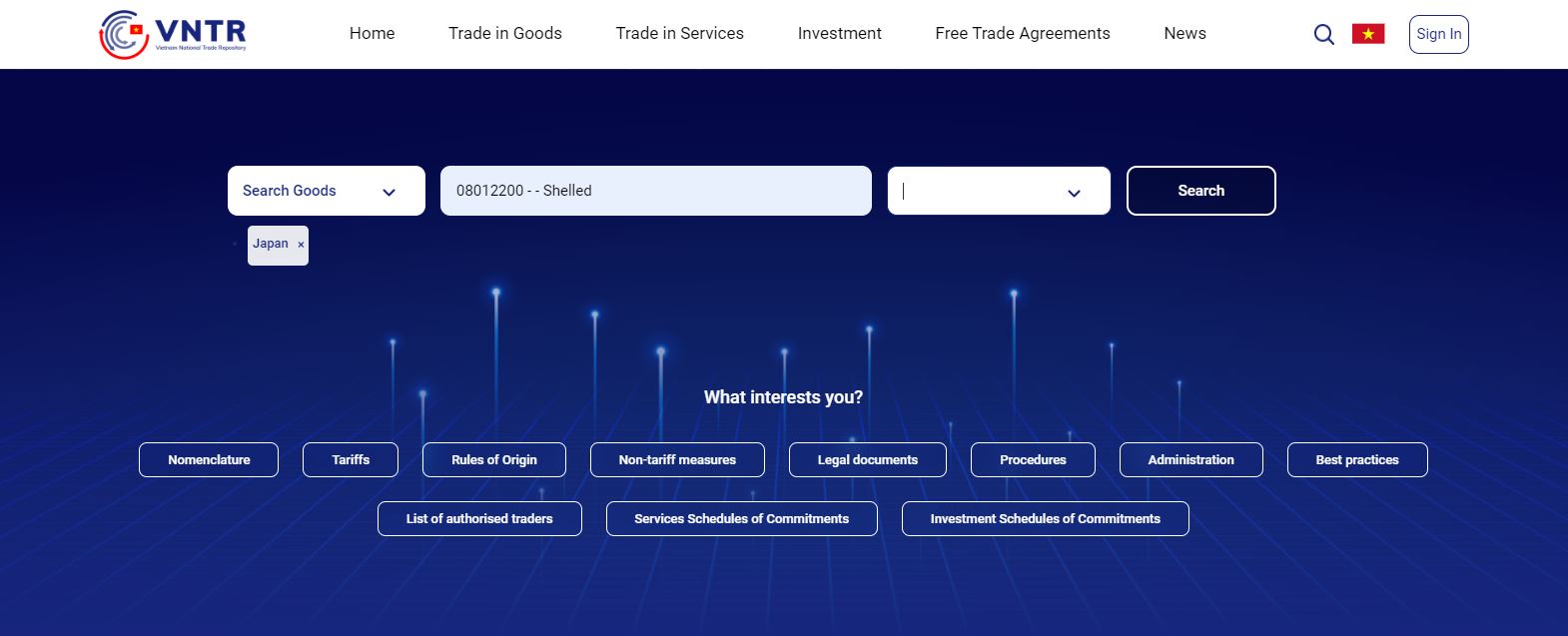

Businesses can search information about import tariffs of Vietnam as well as FTA partner countries at the Vietnam National Trade Repository (VNTR) of the Ministry of Industry and Trade (https://vntr.moit.gov.vn/ / https://vntr.moit.gov.vn/vi)

Not only does it provide the import tariff rates that partner countries apply to Vietnamese goods under FTAs, VNTR also provides information on Rules of Origin to enjoy preferentials under the respective Agreements.

To look up the import tariff rate that an FTA partner applies to goods from Vietnam, businesses only need to enter information about (i) Goods description (by HS code or by product name) and (ii) Importing partner country.

For example:

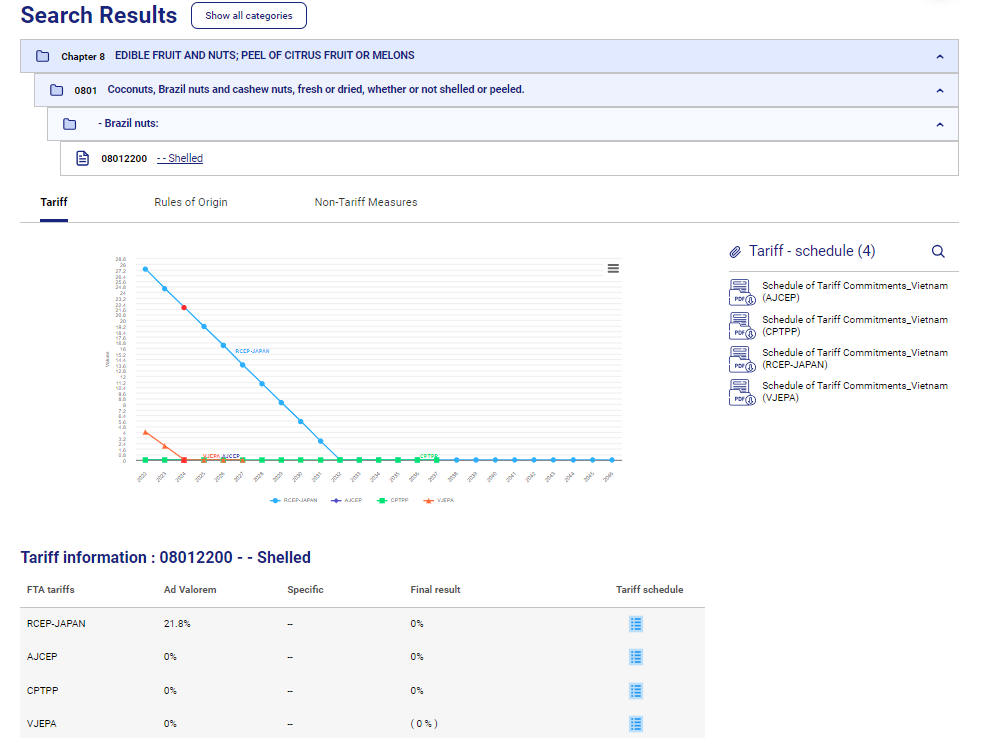

VNTR will display import tariff rates according to all FTAs between Vietnam and partner countries along with a specific tariff reduction schedule for each FTA.

However, the tariff reduction schedule under FTAs is compiled by VNTR according to the commitments of each Agreement. Therefore, to know the exact current import tariff rates that partner countries apply to Vietnam, businesses should look up the current Import Tariffs of the respective importing countries.

Source: Center for WTO and International Trade