TARIC - Integrated Tariff of the European Communities

1. General introduction

The TARIC Data System – European Union (EU) Tariff System (https://ec.europa.eu/taxation_customs/dds2/taric/taric_consultation.jsp?Lang=en) acts as a single-window service to provide businesses and trade promotion agencies with access to trade data and factual information on tariffs in member markets of the European Union Customs Union (EUCU). This data system provides companies looking for potential export markets as well as companies that have been carrying out export procedures with data on tax rates, tariffs, tax deferrals and tax deferrals and relevant tariff information.

The data at the TARIC system is collected from the policies of the members of the European Union (EU), and more broadly, of the European Union Customs Union (EUCU).

2. Basic Functions of the TARIC data system

This portal focuses on two main activities to increase the access of micro, small and medium enterprises (MSMEs) to key market information: i) develop a compatible online application cooperation and integration of relevant and comprehensive tariff information; ii) step up information collection efforts to maximize coordination and ensure completeness and up-to-date information on tariffs.

This includes the provisions of the harmonized system and the combined nomenclature but also additional provisions set forth in the legislation of the EUCU and member customs territories such as tariff pauses, tariff quotas and preferential tariffs, which exist for the majority of the EUCU's trading partners. In trade with third countries, the 10-digit Taric code must be used in customs declarations and statistics.

The system provides free information to help businesses learn about tax rates and market access conditions, and learn about the export process in the EU market.

The TARIC system also includes explanations, instructions and integrated lookup on geographical areas and legal bases to help businesses analyze commercial interests, tariff policies, and provide overview information. on EU law on products and services, as well as contact details for customs and other relevant authorities in EU member states and EU trading partners.

3. Website Structure and User Manual

The TARIC Data System website has the following sections: Measures, Geographical Areas, and Regulations.

The system currently has language options for businesses including: English, Bulgarian, Czech, Danish, German, Estonian, Greek, French, Spanish, Hungarian, Italian, Latvian, Croatian, Dutch, Polish, Portuguese, Romanian, Slovenian, Slovak, Finnish and Swedish.

Enterprises can directly access the website and look up for free the necessary information on tax rates, trade measures, regulations on tariff areas and legal bases in the customs territories of the countries in the EU… TARIC does not require businesses to login to use.

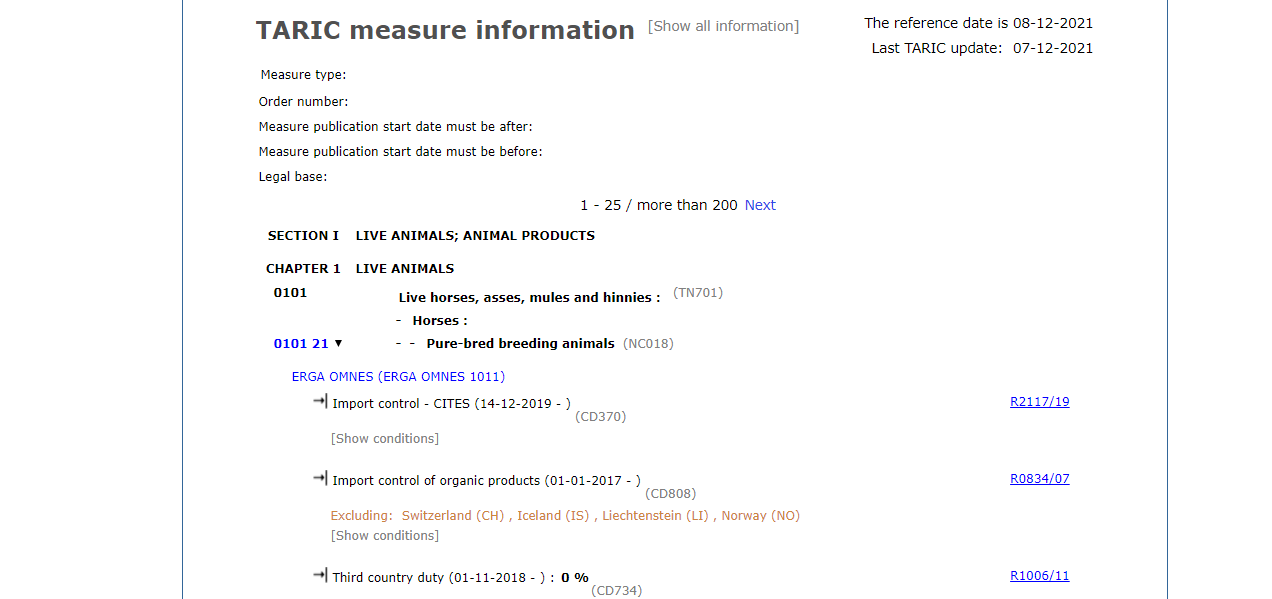

3.1. Measures

In Measures – Section “Goods code”, enterprises will fill in import/export product codes and in the “Origin/destination” section, enterprises country of origin from which the enterprise is located.

After filling in all information and pressing “Retrieve Measures”, a series of specific information about import and export tariffs to the country you choose will appear.

The information includes:

- Measure type;

- Geograpical areas;

- Conditions apply (Conditions);

- Effective date (Date);

- Legal basis;

Enterprises will select specific information that they need to find about tariffs in the market and related products they are interested in.

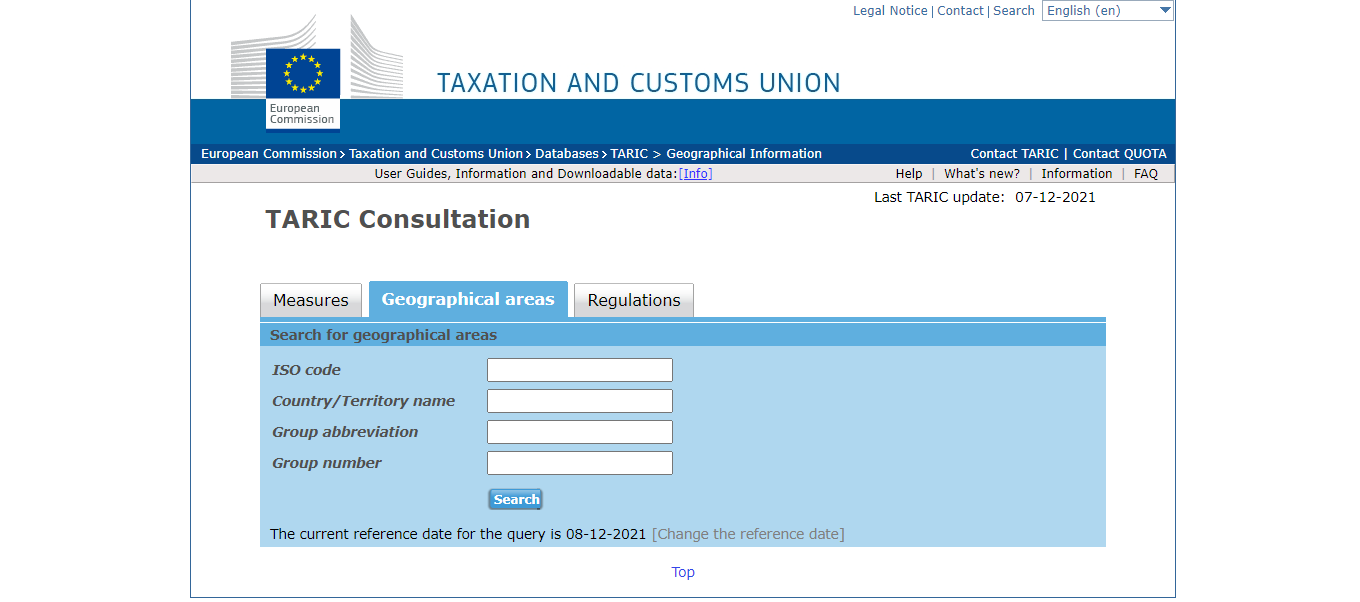

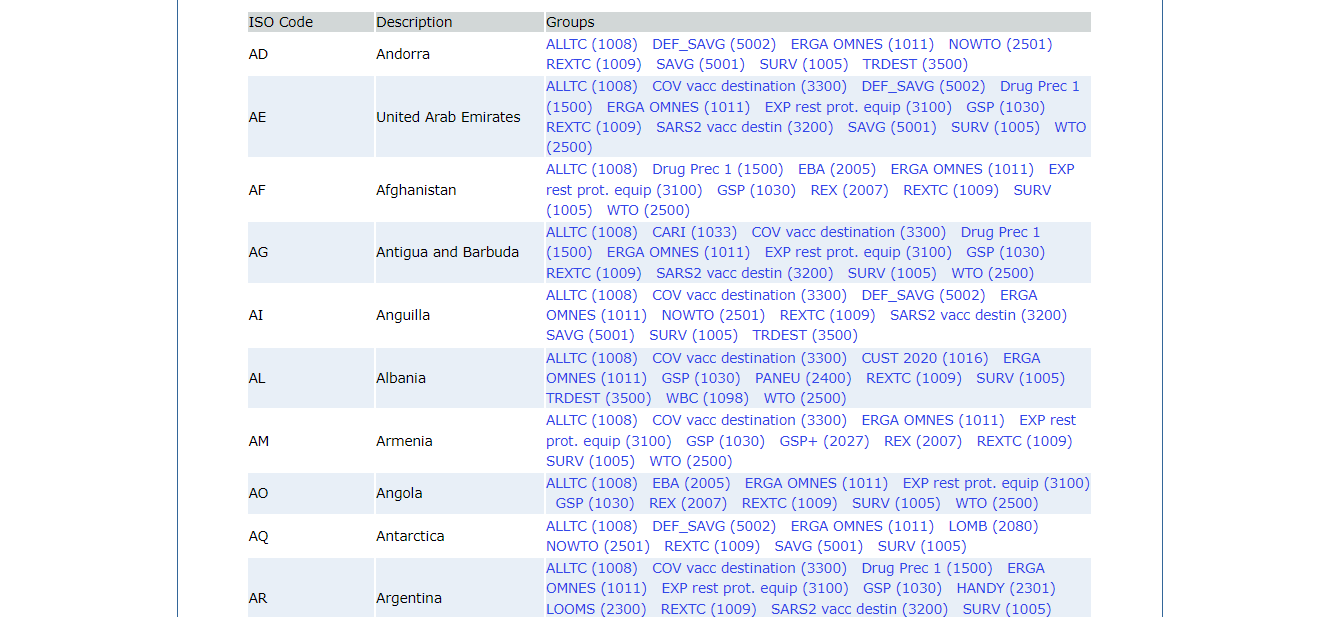

3.2. Geographical areas

In the Geographical Areas – Section “ISO code”, businesses will enter the ISO code of the country they are looking for information. In the "Country/Territory name" field, businesses will enter the territories and countries that they are interested in, especially the country of origin of the goods. In the "Group abbreviation" section, businesses will enter the abbreviations of the groups of countries that they are interested in. In the "Group number" field, businesses will enter the codes of the groups of countries that they are interested in.

After filling in any information and clicking “Search”, a series of specific information about which country belongs to which geographical area, and country code will appear.

This information is for businesses to look up Measures in the Measures section.

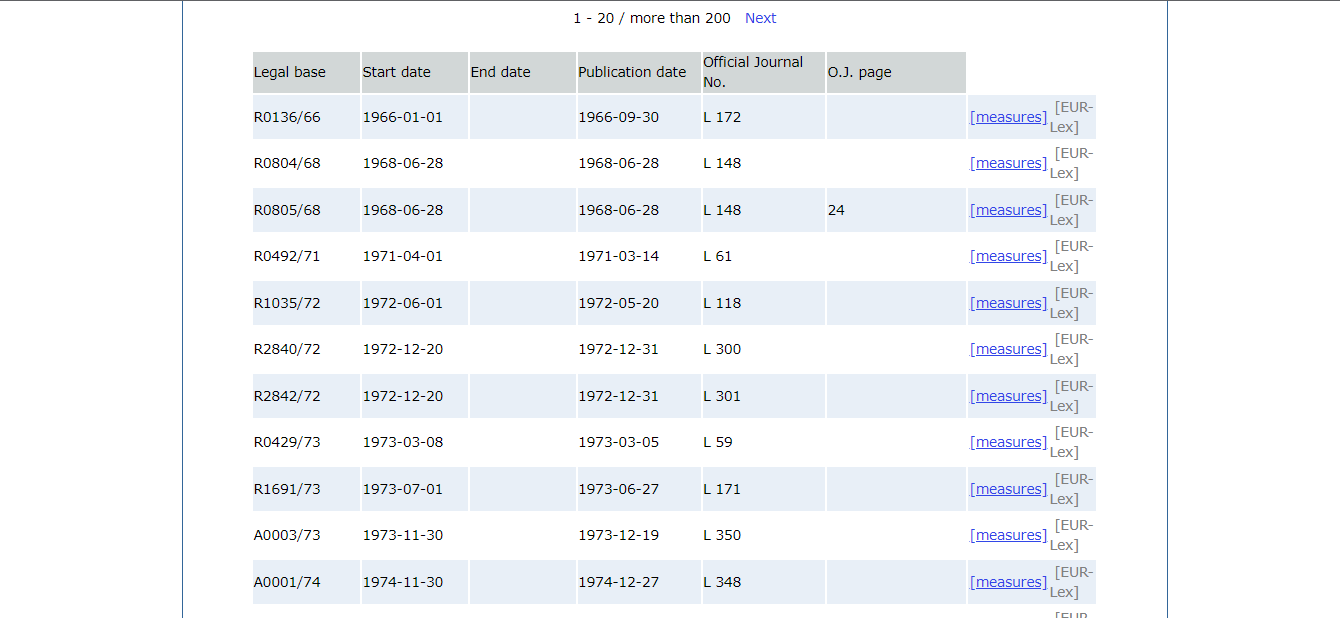

3.3. Regulations

In Regulations – Section “Official Journal” you will enter the publication code of the legal regulations of the EU (OJEU) that you are trying to find out information about. In the "Publication Date" field, the enterprise will enter the time period that the law was published in the OJEU that the enterprise needs to search. In the "Regulation date" section, businesses will enter the time period that they are interested in to search for effective documents.

Then fill in any information and press “Search”, a series of specific information about the legal basis, effective date and expiration date of the measures as well as information related to the publication of OJEU by measures will appear.

This information is provided for businesses to look up Measures in the Measures section.

Source: Center for WTO and Integration - VCCI